Should You Be Feeling Good or Bad About the New Tax Act?

Everyone is trying to figure out how the new Tax Act affects them. As a real estate professional, you experience the benefits and burdens of being an independent contractor. It’s up to you to not only earn money to support your lifestyle but to set aside money from your commissions to pay for expenses, taxes and to fund your future retirement. Have you determined whether your tax bill will go up or down? Your current tax liability and your future retirement are two costs you need to plan for.

The Tax Cut and Jobs Act of 2017

Section 199A pf The Tax Cut and Jobs Act of 2017 provides a brand new 20 percent deduction of qualified business income for certain pass-through businesses.

Pass-through entities include:

- Sole proprietorships (no entity, Schedule C)

- Real estate investors (no entity, Schedule E

- Disregarded entities (single member LLCs

- Multi-member LLCs

- Any entity taxed as an S corporation

- Trusts and estates, REITs and qualified cooperatives

However, personal service businesses lose this deduction when their taxable income exceeds the following thresholds:

- $157,500; phased out by $207,500 for single tax payers

- $315,000; phased out by $415,000 for married filing joint payers.

Section 199A service businesses include the following:

- Real Estate Professionals

- CPAs

- Attorneys

- Athletes

- Financial Advisors

- Doctors and Dentists

- Consultants

- Performing Arts

When income exceeds the phase-out threshold the deduction provided by a large qualified plan contribution can bring taxable income below the phase-out threshold regaining the 20 percent deduction in addition to the deduction for the qualified plan contribution.

SAMPLE

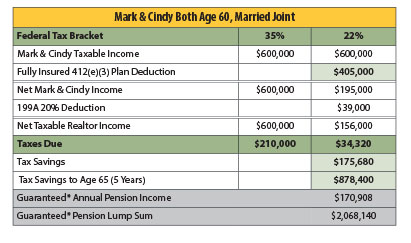

Mark and Cindy, a married REALTOR® team, are both 60 years old and making $600,000 in combined net commission income. They file their tax return as married, joint.

- Mark and his wife can contribute $405,000 to a Fully Insured 412(e)(3) Plan

- Mark and Cindy get a full deduction for the $405,000 Fully Insured 412(e)(3) Plan contribution and will also qualify for an additional Section 199A deduction of $39,000.

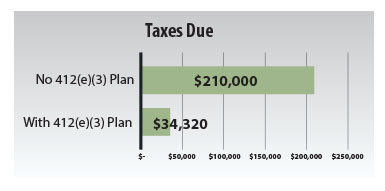

- Contributing to the Fully Insured 412(e)(3) Plan contribution reduces their current tax liability by $175,680

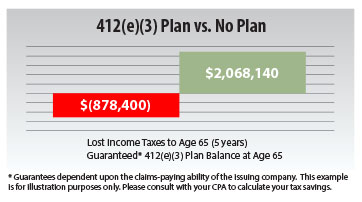

- Tax savings add up to $878,400 by the time Mark & Cindy turn 65

- Mark and Cindy will be able to retire at age 65 with a combined pension income of $170,908 per year and will have lump sum balances totaling $2,068,240.

For Mark and Cindy, the decision to implement a Fully Insured 412(e)(3) Plan or not is a $2,946,540 decision! They can either pay $878,400 in taxes over the next 5 years, or they could save $2,068,140 in their Fully Insured 412(e)(3) Plan.

The adoption of a Fully Insured 412(e)(3) Plan meaningfully reduces the estimated current tax liability and brings their taxable income below the new 199A deduction threshold limits regaining the 20 percent deduction. The Fully Insured 412(e)(3) Plan also created significant pension income without market risk.

Think about your situation:

- Will you keep your 20 percent deduction?

- Do you want to meaningfully reduce your current tax liability?

- Do you want the IRS to help you accumulate assets for your retirement?

- Would you like a secure pension income with peace of mind?

Contact 412e3@compasstrategiesllc.com for more info.

Jim Hiza, CPA educates real estate professionals, CPAs, small business owners and estate planning attorneys on how to utilize the Tax Code to meaningfully reduce current tax liability and accumulate wealth. He has more than 20 years of financial planning and investment management experience working with families and business owners.

Mary Read CPC, QPA, CPFA is National Director of Pension and Protection Planning at Pentegra Retirement Services and partner of M&R Business Development Group. A leading authority in qualified retirement plans with more than 30 years experience, she has an extensive background in plan design and development.