Surviving Financially as an Independent

It’s been tough financially for so many people during the pandemic. People can’t pay their bills. REALTORS® are no different.

“There are definitely people getting out of the business,” says Matt Perry, operating principal of Th e Perry Group at Keller Williams Realty, Raleigh-Durham.

But for those still hoping to succeed in the industry and in their own finances, there are steps to take, challenges to meet and a new way of thinking.

Biggest Challenges

“Agents were in a breeze mode for a while with the wait-and-see attitude when the coronavirus hit the country. They watched the news which surrounded them with lots of negativity,” Perry adds.

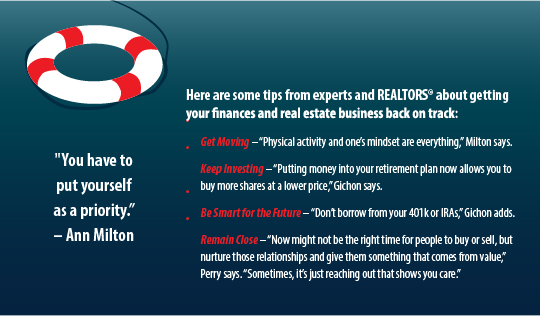

“But we are focusing now. Our mindset is so important,” he states. “You need to focus on what you can control. We can’t control COVID-19 or the restrictions that were upon us. But we can have a positive mindset and look at this as an opportunity instead of a crisis.”

Perry believes that activity and actions can save an agent’s business.

“You need to figure out what are the actions you will be taking on an hourly, daily, weekly or monthly basis to move your business forward,” he says.

Perry has encouraged his agents to send out lots of videos, create zoom calls and phone calls and engage other people to let them know you are there for them.

“There are still so many things that are good to be shared with others,” he adds.

Many people are still buying houses, and a lot of people are refinancing now because of great interest rates. That information can be shared and can give other people hope.

Keeping Busy and Keeping Connections Strong

Ann Milton’s advice to her agents has also included nurturing the relationships they already have with past clients and their sphere of influence. Milton, the owner of Ann Milton Realty in Lillington, even hired a motivational speaker to come and speak to her agents in May to help them rekindle the spark to do business again.

“They need to talk with the people they know and tell them we are here to help with things, not just real estate,” she adds.

Some of her agents had to go to their mortgage lenders for payment deferments. They didn’t want to lose their homes. Helping clients who are fearful of the same situation became part of an agent’s daily reach out.

“For those still trying to sell homes or find buyers, don’t be afraid to ask for business,” says Galia Gichon, an independent personal financial expert. After working on Wall Street as a bond research analyst, she founded the New York-based Down-to-Earth Finance, a financial education firm.

“Initially, some people who have their own businesses were afraid to ask for more business,” she adds. “I have a client who is an interior designer. She felt bad about asking people to hire her during this bad economic time. But she put it out there that she’s available, and she got five people to respond who wanted her to come to their homes.”

“As a freelancer myself, it’s tough when all of a sudden, a client drops out. It all has to start with little steps and really looking at your overall money situation,” Gichon states.

Since the pandemic began, Gichon has been doing webinars and workshops online to help others figure out their cash fl ow and overall money situations. She stressed that you can change things, but it takes a little time.

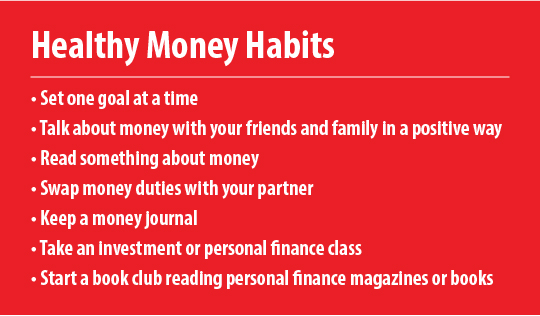

“Lifelong healthy money habits can give you power for personal and professional success,” Gichon says.

Things Could Continue Down for a While

“March and April were not the devastating months for agents like the general public thinks,” Perry says.

“Closings were happening, and the real estate people were not feeling the financial hit in May and June, generally,” he says. “Most people had some record months in March and April.”

But when the pandemic hit hard in March, some REALTORS® shut down and went on vacation or just stopped working because they wanted to or had to. Some had kids they had to homeschool when schools closed. That lack of activity will mean a lack of results and commissions from June through August, he adds.

“Those are the months that they will see a decline in money. The market numbers could drop as little as 20 percent or even 50 percent,” he states. “The kids will be home most of the summer now until September, even if they go back at the end of summer.”

That means more REALTORS® who must stay home for family responsibilities will not have the time to put into business.

“I find in this type of situation (like the pandemic) that people either freeze, fight or flight,” Perry explains. “But if you look at this as an opportunity instead of a crisis, things can get better.”

What to Do Next If You are Financially Strained

What to Do Next If You are Financially Strained

Gichon suggests her clients examine their fixed expenses for the next three months. Those include rent/mortgage, car payments, groceries, cell phone, utilities, child expenses, eating out and delivery, debts like credit cards and all insurance premiums. “These are all those bills that keep you living the life you live,” she says.

You can make it easier by choosing a personal finance app for your phone to put everything in one place. Gichon suggests apps such as mint.com, Your Bank, Wally, YNAB and more.

The Consumer Financial Protection Bureau (CFPB) has a lot of information and resources to ease the strain of those dealing with serious financial hardship caused by COVID-19. The biggest thing is keeping up with your bills.

“Keep in mind that if you decide to use a program that lets you pause or reduce payments, you will still owe the money you have not paid once the program ends,” the website emphasizes.

But if you can’t pay your bills on time or for the amount needed, the CFPB says to not hesitate to contact your lenders and creditors. Lenders are being encouraged to work with their customers during this pandemic. The CARES Act also suspended payments on federally-held student loans through Sept. 30, 2020. But if you have student loans other than federally-held ones, you must call your servicer.

Sometimes just cutting expenses can help with the stress on your bank account and your mind. The CFPB gives these examples:

- Find local restaurants’ cost-saving specials like “kids eat free” nights.

- Switch to lower-fee or no-fee financial institutions.

- Buy needed clothing and furniture at second-hand shops or wait for sales.

- Use coupons.

- Investigate if you are eligible for energy assistance, weatherization programs or discounted utility rates.

- Pay bills on time to avoid penalties or late fees.

- Get rid of gym memberships if you don’t use it regularly.

- Cancel discount store memberships if not using them.

- Consider prepaid or fixed-rate phone plans.

- Discontinue cable or streaming services.

“You have to put yourself as a priority,” Milton says. “I encourage my folks to set up three accounts—one for operating, one for taxes and a sunshine fund. There might be rain, but we will make it through.”

Lee Nelson is a freelance journalist from the Chicago area. She has written for Yahoo! Homes, TravelNursing.org, MyMortgageInsider.com and REALTOR® Magazine. She also writes a bi-monthly blog on Unigo.com.